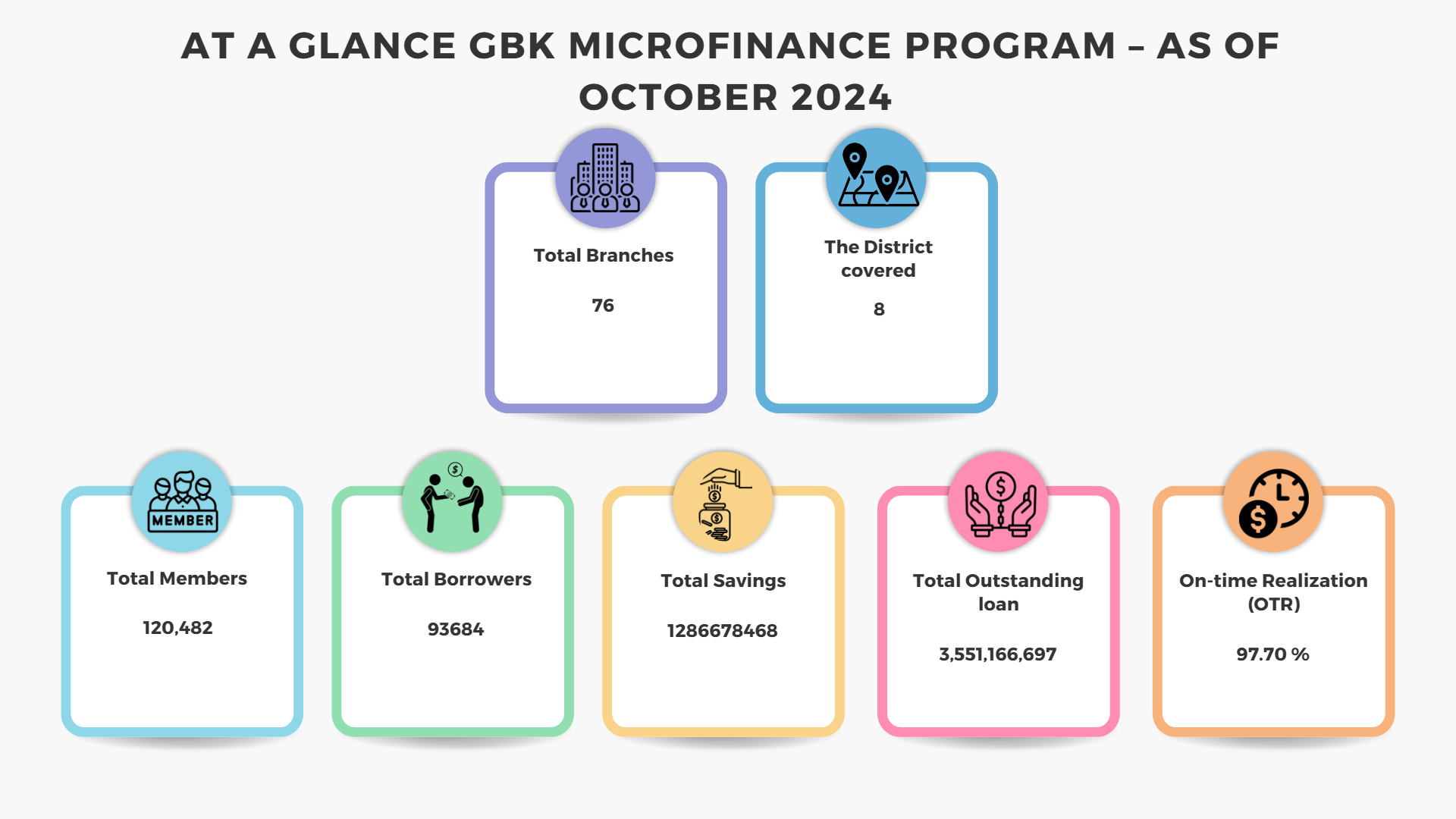

FINANCIAL SERVICES:

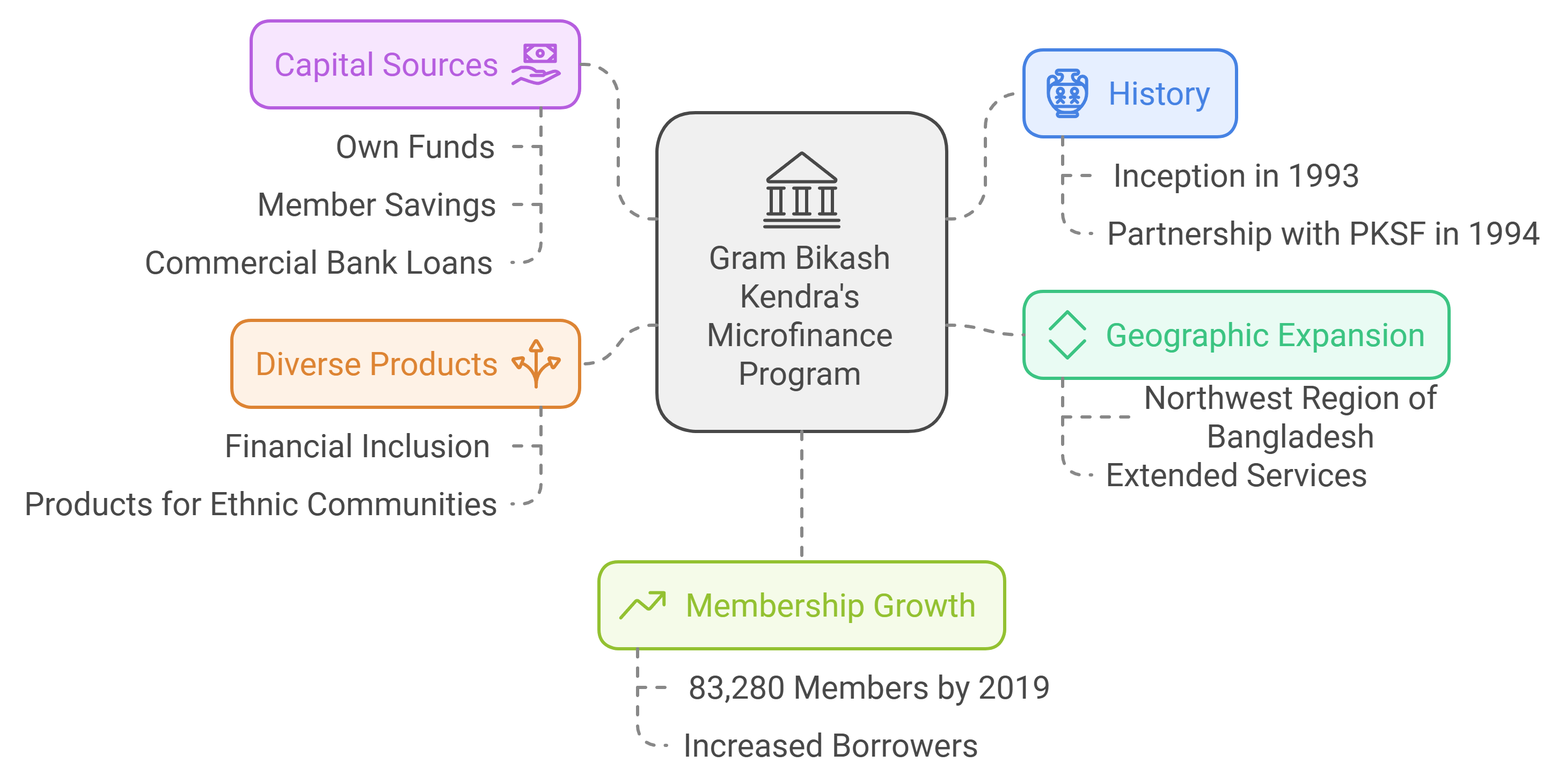

Gram Bikash Kendra-GBK, a regional-level development organization working in the northwest region of Bangladesh started its Microfinance program in 1993 with only 23 Members. Afterward, GBK obtained a partnership of Palli Karma-Sahayak Foundation (PKSF), the country's leading microcredit financing organization of Bangladesh in 1994. Since then, GBK extended its program both geographically and reaching more people under its services. Nowadays, GBK’s microfinance program is serving diverse peoples with number of products and services. Suitable products have been developed for to address diverse communities’ needs e.g. products have been developed for financial inclusion of the socially marginalized ethnic, Dalit and other such communities who are often deprived of microfinance services. As on 30 June 2019, GBK’s microfinance program covered 83,280 members, and become categorized as “A” category partner of PKSF. The increasing demand, number of members, and borrowers led GBK to diversify its sources of capital. In these growing circumstances, GBK is sourcing its capital from own funds, member’s savings, and loan from commercial banks to cover borrowers increasing requirements.

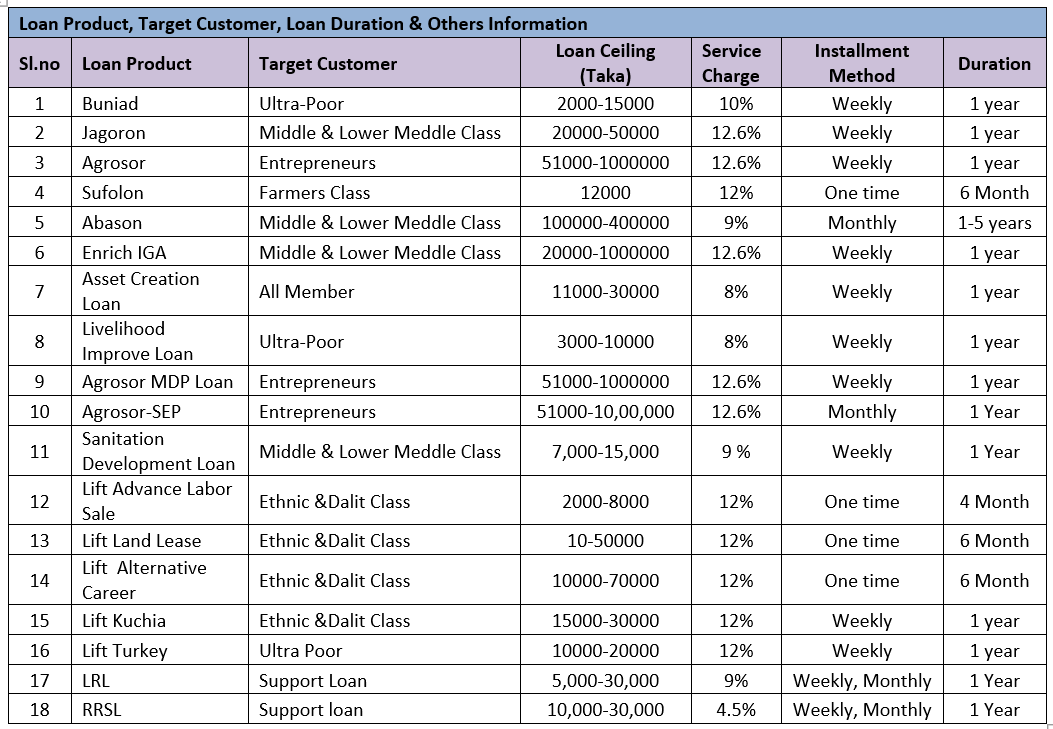

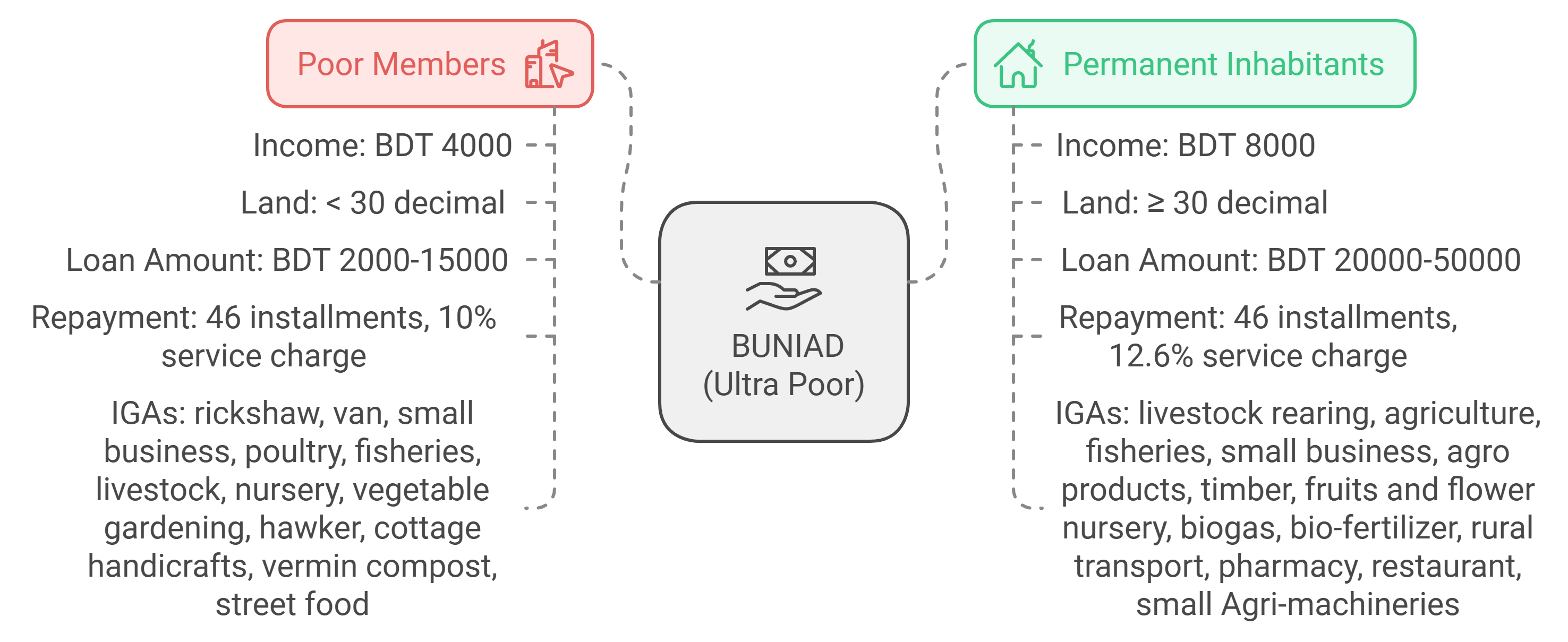

BUNIAD (Ultra Poor)

This component covers the poorest members who are land less or own less than 30 decimal land, floating, and widow, live in road side or embankment and fully depend on physical labor, having monthly income of approximately BDT.4000. They are given loan BDT.2000-15000 for different, IGAs like- rickshaw, van, small business, poultry, fisheries, livestock, nursery, vegetable gardening, hawker, cottage based handicrafts, vermin compost, street food stall etc. Loan is recovered in 46 installments throughout the year with 10% service charge. The permanent inhabitant households that have monthly income of BDT.8000 and have at least 30 decimal cultivable lands are eligible for this product. They are given loan BDT. 20000-50000, recovery within 46 installments with 12.6% service charge. Their businesses are mainly livestock rearing, agriculture, fisheries, small business, agro product and livestock business, timber, fruits and flower nursery, biogas and bio-fertilizer, rural transport, pharmacy, restaurant, small Agri- machineries and like others.

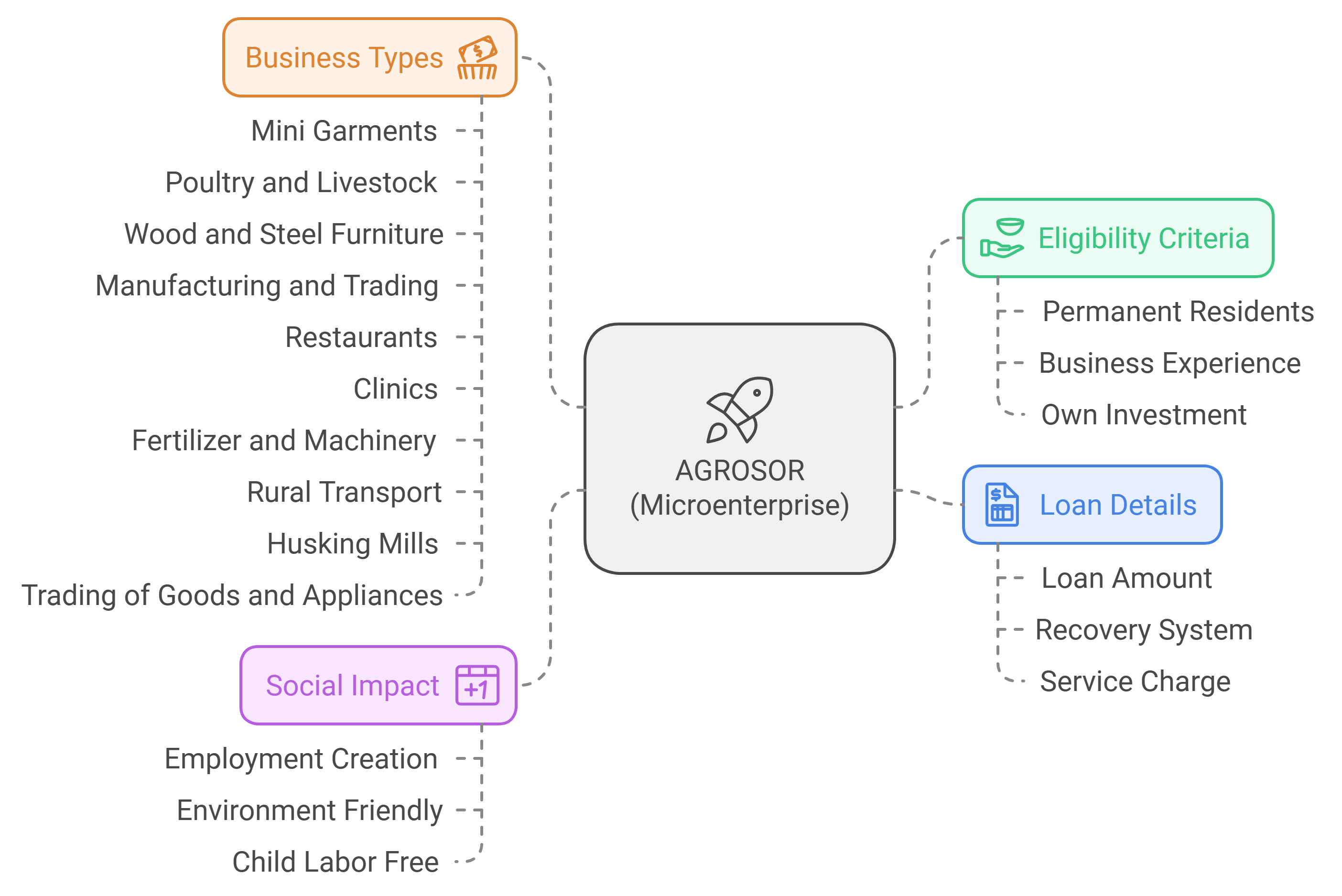

AGROSOR

(Microenterprise)

This product is for advance members and it’s mainly entrepreneurship development. These members are permanent inhabitant, have at least 3 years’ experience in proposed business in which s/he is presently involved in. The businesses will have to have employment creation opportunity, environment friendly and free from child labor. The entrepreneur must have at least 50% investment of her/his own. Loan ceiling for these members are BDT. 51000-1000000 and recovery system is weekly or monthly with 12.6% service charge in 46/12 installments. Few of the business/enterprises are mini garments, poultry and livestock firm, wood and steel furniture, manufacturing and trading business, restaurant, clinic, fertilizer and firm machineries business, Agri-machineries and rural transport, husking mill and trading of different goods and appliances.

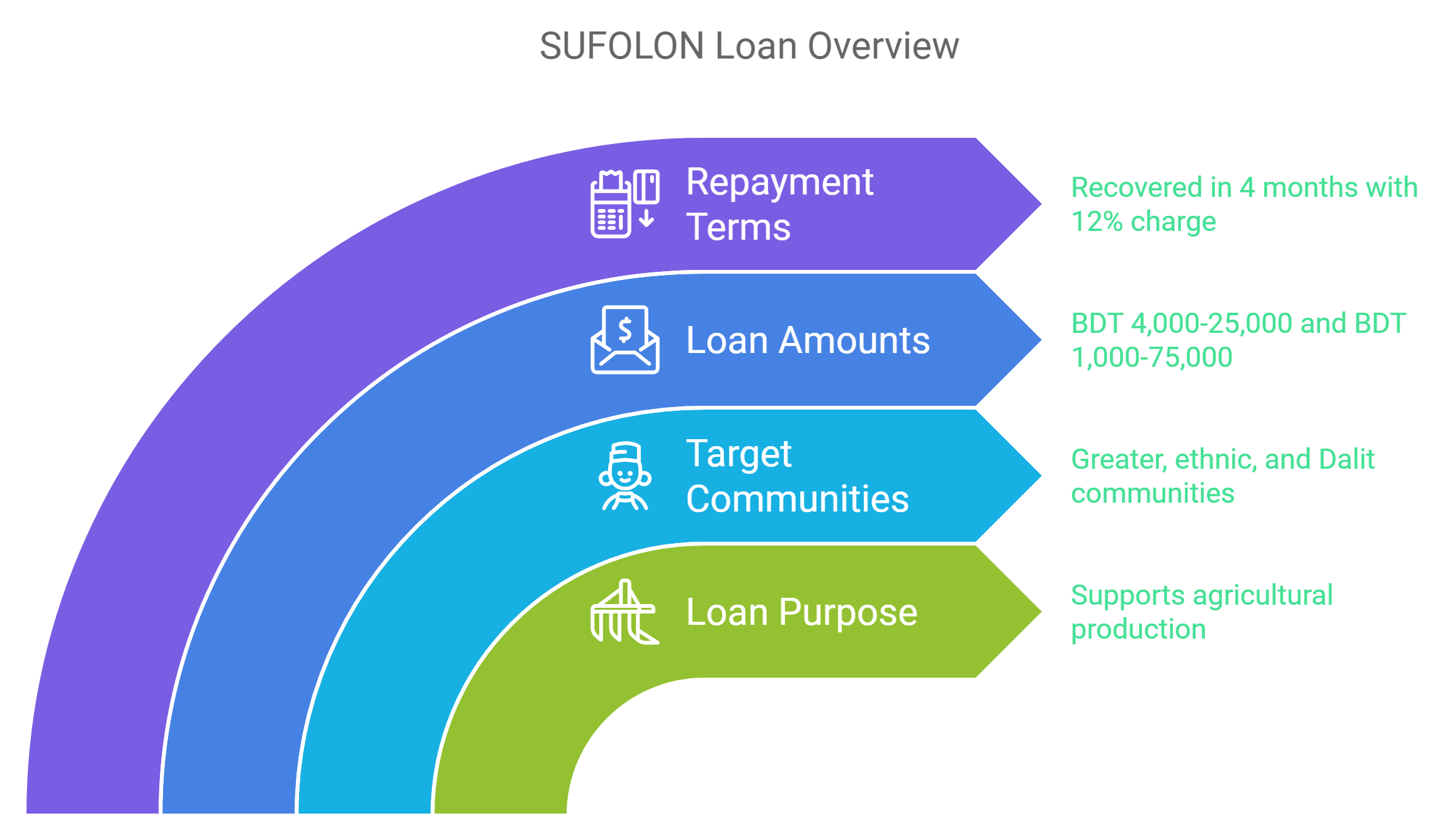

SUFOLON (Seasonal Agriculture)

This component of loan product is for the members who produce agricultural products (food grains, vegetable, fruits, milk, meat, fish and others). Its season based loan product. Ceiling for greater community members is BDT. 4000-25000 and for ethnic and Dalit community, it’s BDT.1000-75000. Loans are recovered at a time within 4 months with 12% service charge.

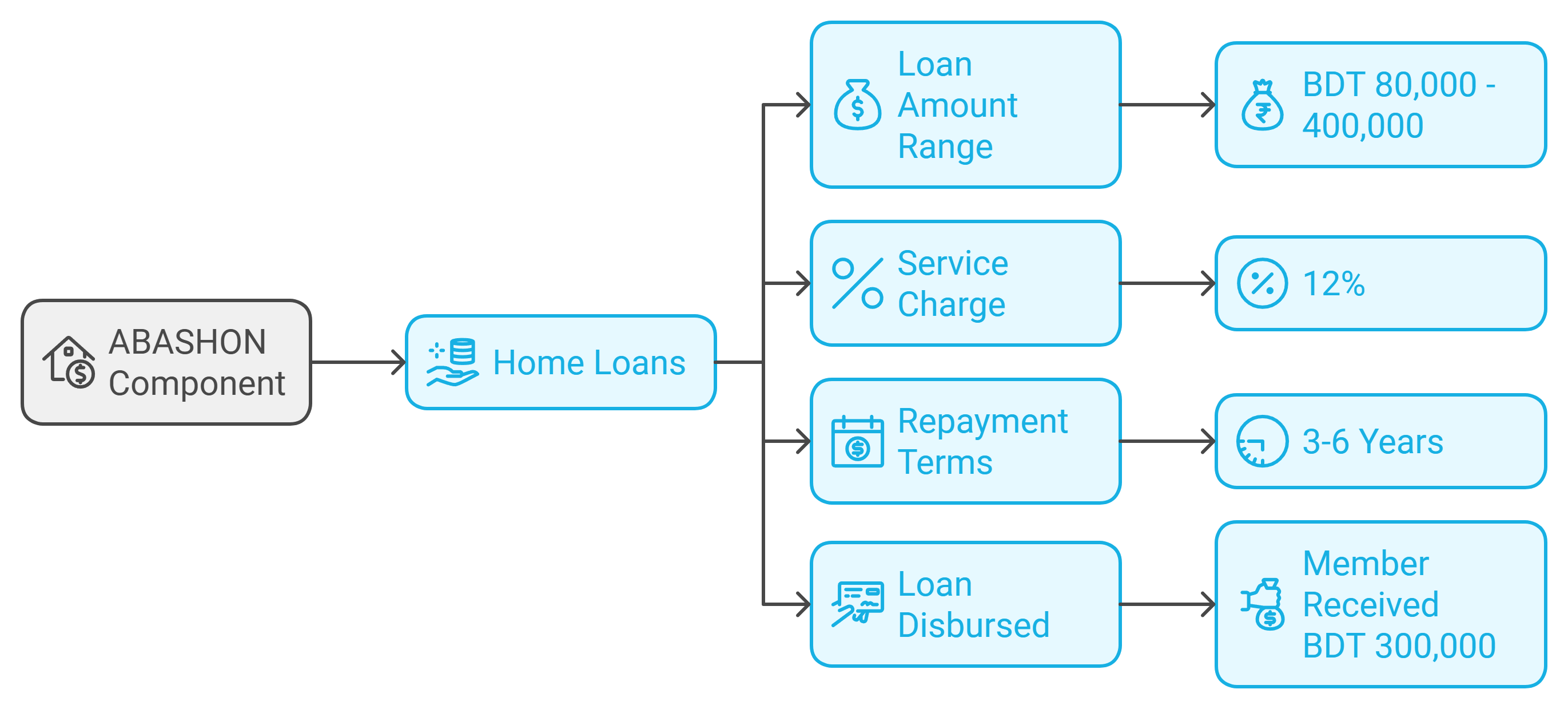

ABASHON (Middle & Lower Meddle Class)

During this reporting period under the component ABASHON offered the product with the home loan for the members. This component mainly worked at Parbatipur Upazila in Chandipur under the municipality area. In the reporting period one member got the home loan BDT. 300000/- . The ceiling of the loan is BDT.80000-400000. Loans are recovered at a time within 3-6 years with 12% service charge.

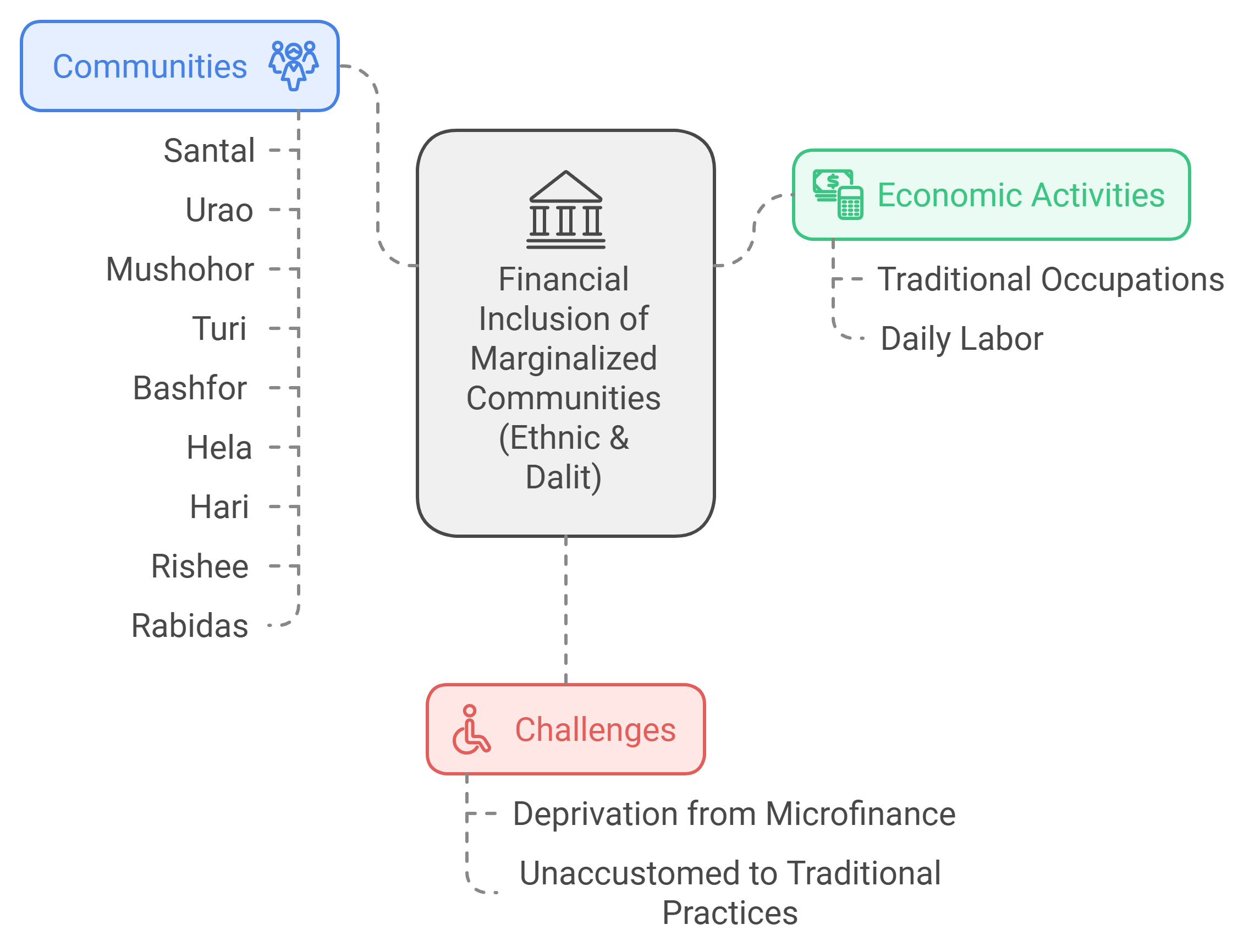

Financial Inclusion of Marginalized Communities (Ethnic & Dalit)

There are numbers of socially and economically marginalized communities live in the northwest region of Bangladesh where GBKs mainly. These marginalized communities are mainly ethnic and Dalit communities consisting of different groups namely-Santal, Urao, Mushohor, Turi, Bashfor, Hela, Hari, Rishee, Rabidas and others. Few households of these communities live on their traditional occupation and remaining most of them live from hand to mouth by selling daily labour. They are often deprived from microfinance services, as they are un habituated in traditional microfinance practice.

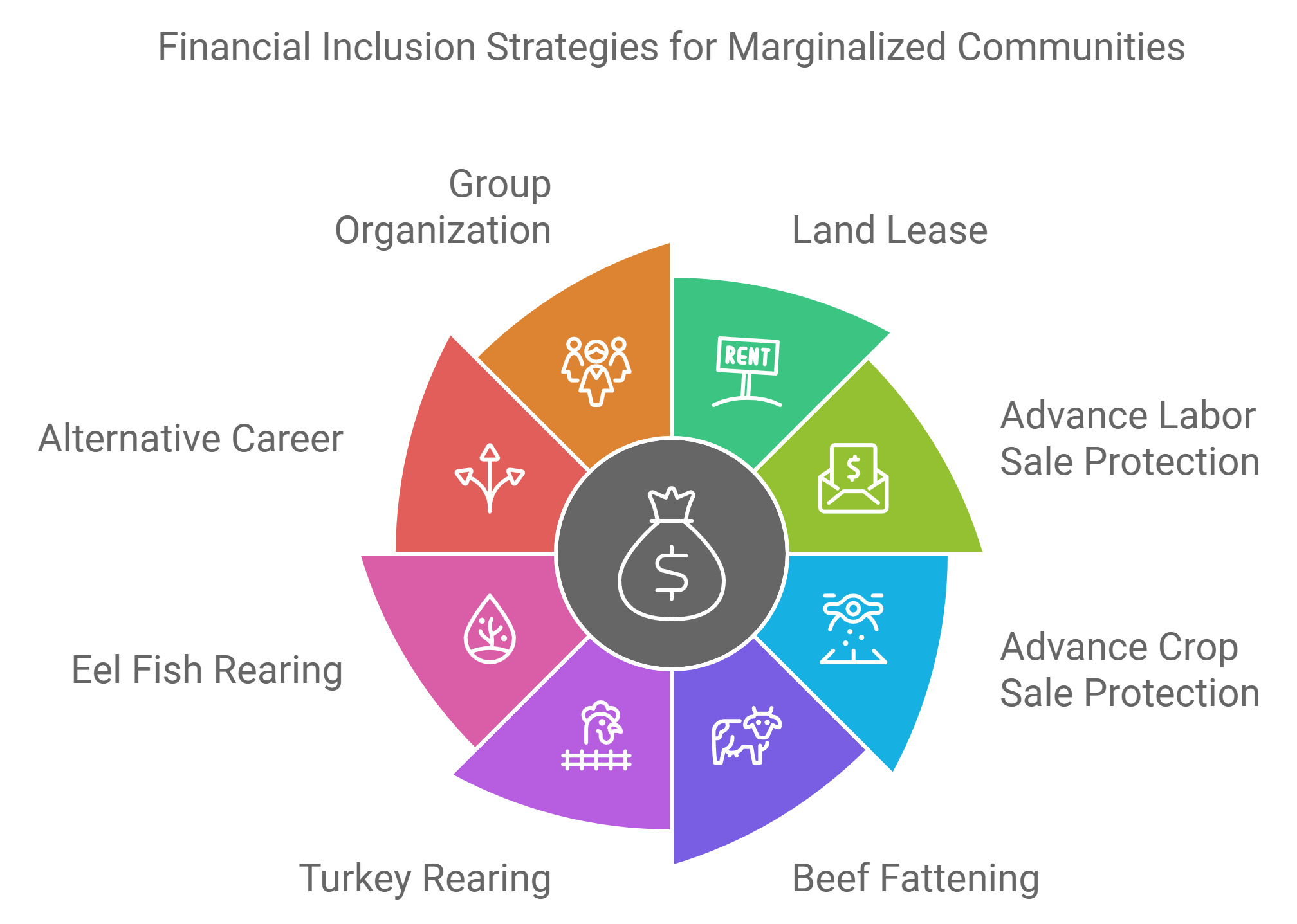

GBK is being working with these marginalized communities since long times and was thinking about financial inclusion of these marginalized communities. Considering their needs, capacity, habit and culture, GBK developed suitable product for the socially marginalized communities and including them under financial services. For example: Land Lease, Advance Labor Sale Protection, Advance Crop Sale Protection, Beef Fattening, Turkey Rearing, Eel Fish Rearing, Alternative Career etc.,. They have been organized in-group, meetings are conducted according to their convenient time, they have been provided suitable loan for different IGAs like-shoe making, native chicken rearing, cow rearing and like other business. Recovery of these loans is defined on their suitability instead of traditional weekly system

GBK’s

Microfinance: A 5 Years Overview

Member and Borrower outreach:

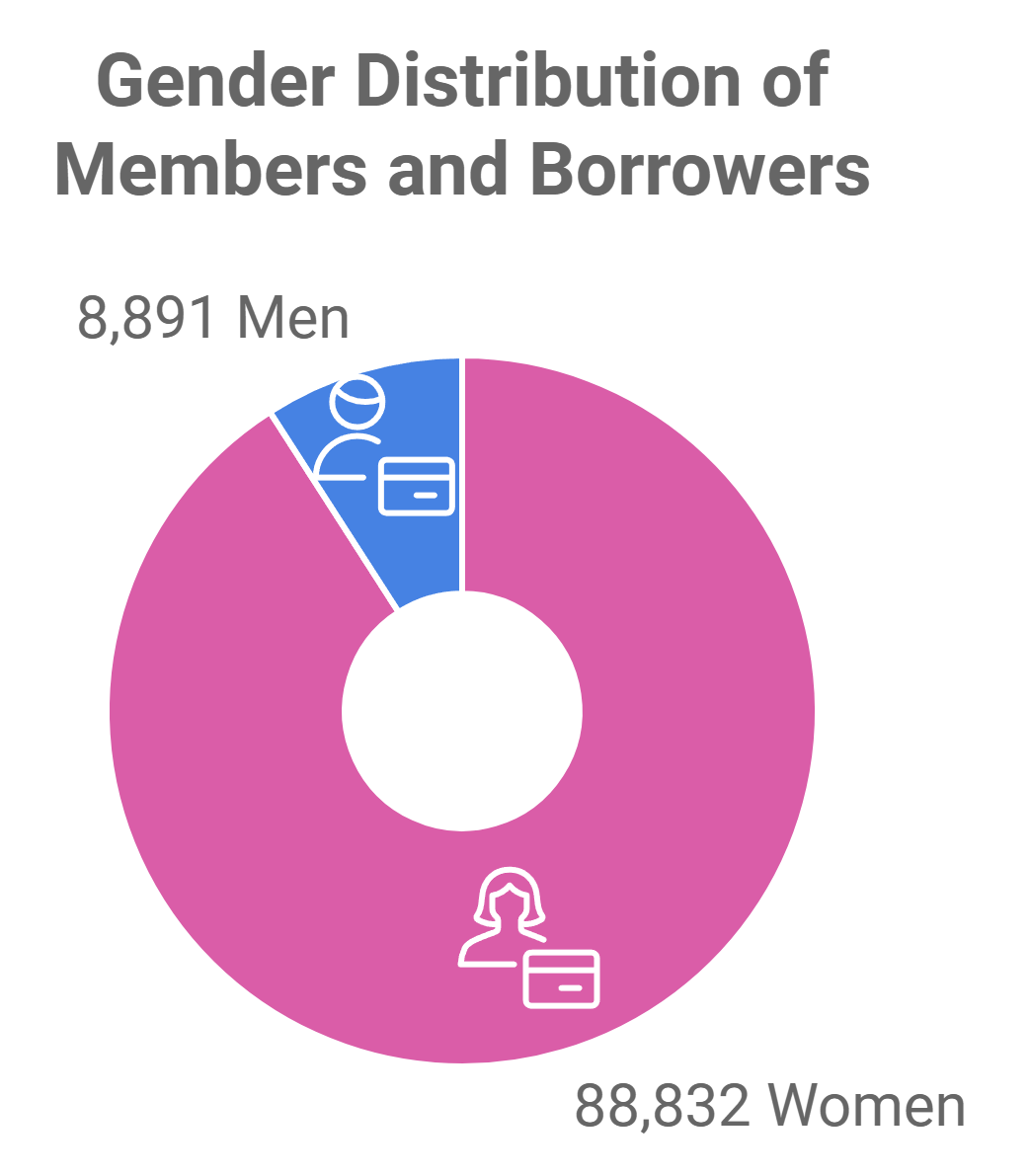

The number of active members stands at 89721 and borrower stands at 67681 as of June, 2021 of which member of 88,832 (99.01%) are women.

Join the world’s biggest family

Subscribe

STAY INFORMED. Subscribe to our newsletter.